Hiscox acquires the Economic Insurance Company

The Economic Insurance Company name changes to the Hiscox Insurance Company, enabling the Hiscox Group to underwrite in both the Lloyd’s market and the retail markets.

We can trace our roots....

The Economic Insurance Company name changes to the Hiscox Insurance Company, enabling the Hiscox Group to underwrite in both the Lloyd’s market and the retail markets.

Hiscox Dedicated Insurance Fund plc buys the remaining 75% of Hiscox Holdings Ltd, and changes its name to Hiscox plc.

Lloyd’s members pass the Reconstruction and Renewal plan to settle litigation in the market with a general compromise settlement of losses.

In 1994 Hiscox begins to build a team to meet the professional indemnity needs of specialist professional services firms such as IT consultants, advertising agencies, management consultants, PR firms and other similar businesses.

Richard Billingham, Ray’s a laugh, 1994

View full artwork

Nina Murdoch, Dawn, 1995

View full artwork

Hiscox opens its first German office in Munich distributing art and private client products including ‘Haus and Kunst’.

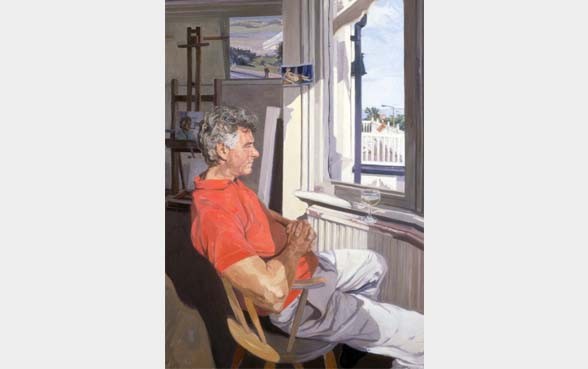

John Wonnacott, Ian with Renown, 1990-1992

Hiscox forms Hiscox Select Insurance Fund plc, the first quoted corporate spread vehicle at Lloyd’s supporting a selection of syndicates.

In the same year, Hiscox forms the first (and only, in 1993) dedicated vehicle, Hiscox Dedicated Insurance Fund plc, supporting Hiscox Syndicates only.

A position he holds from 1993–5.

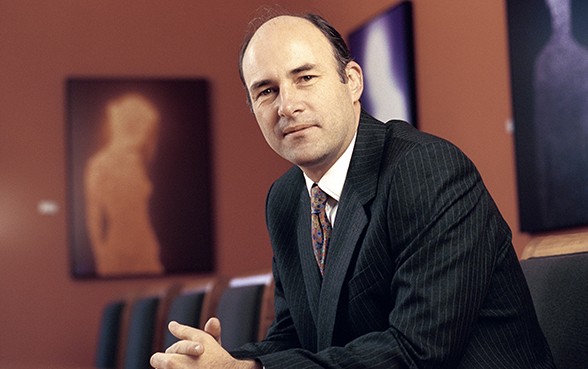

Bronek Masojada, working for McKinsey, is involved in the first business plan ever for Lloyd’s in 1993.

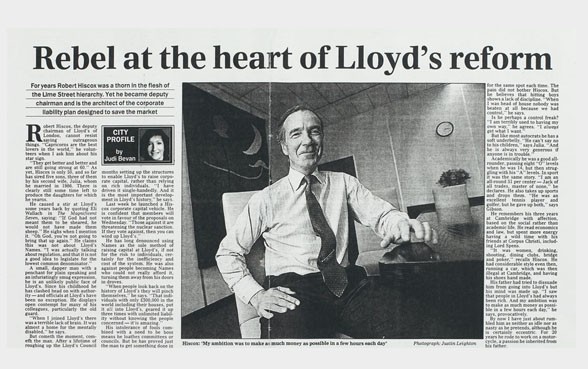

Robert Hiscox leads the introduction of corporate capital to Lloyd’s in 1993 which produces almost £1 billion of capital to the market and stems the outflow of individual members (Names).

Equitas is formed to take all liabilities prior to 1993, leaving the Lloyd’s market with a clean slate to continue underwriting.

In 1994 Robert leads the work on the auction of capacity so that individual Names could buy and sell capacity on syndicates.

Hiscox opens their first office outside of the UK as the head office for the European business.

The office is home to the Paris northwest regional underwriters in kidnap and ransom, direct-to-consumer, personal indemnity claims, marketing and operations. Hiscox Re services France, the Middle East and North Africa from Paris.

Robert Hiscox persuades Bronek to join Hiscox as Managing Director.

Friday, 10 April: the IRA detonates a vehicle bomb in the City of London killing three and injuring 91 people. The Baltic Exchange is destroyed and surrounding buildings severely damaged.

Image: This Hiscox photograph album was one of many assets damaged in the blast.

24-year-old Paul Lawrence joins Hiscox Syndicate 33 as Underwriting Assistant in the fine art team. Paul gained his ‘scratch’ and started to underwrite fine art in 1993.

Robert Hiscox is a member of the task force which, under the chairmanship of David Rowland, formed to seek solutions to the growing problem of losses at Lloyd’s. McKinsey is employed to assist the task force. One member of the team is a young South African, Bronek Masojada.

Frustrated by traditional policy wordings packed full of exclusions, warranties and average clauses, Robert Hiscox and then business partner Nicholas Thomson, lock themselves away in a London hotel room, refusing to emerge until they’d achieved their goal: a home and contents policy wording of complete clarity.

“The new 606 policy has been drafted around my boredom threshold both as to readability and detail. Documents that cannot be easily read and understood tend not to be read at all and I believe that the language of our policy overcomes this problem.” Nicholas Thomson

Hiscox Underwriting Ltd is formed to find and underwrite business for Hiscox-managed syndicates outside the London Market.

Pollution and asbestosis claims arising on policies written over many previous years start to cause serious losses to syndicates. With reserves depleted, the market is hit by catastrophic losses such as the Piper Alpha oil rig explosion. Lloyd’s syndicates had been encouraged by foolish regulation to reinsure each other, so losses bounced around the market multiplying the original loss (known as the ‘spiral’).

Robert Hiscox commented, “Our logo (the fleur-de-lys) is very much like the Boy Scouts logo. As their motto is ‘Be prepared’ this seemed very suitable. As for the royalty issue, we were an upmarket brand and should not be ashamed to show it.

A brand consultant asked if I had a coat of arms to go above the Hiscox and I said it would be a bit pompous to have a full coat of arms, but looking down on the ring on my finger, I said what about a fleur-de-lys which is in the Hiscox arms. It was agreed.”

Hiscox Holdings Ltd is formed as the Group’s holding company, with two major subsidiaries: Hiscox Syndicates Limited as managing agent and Roberts & Hiscox Ltd as members’ agent.

Hiscox takes its first steps into UK retail business with local specialty insurance.

Robert joins from CE Heath and serves as the Active Underwriter of the Hiscox Lloyd’s Syndicate 33 between 1993 and 2005.

A 23-year-old Richard Watson joins Hiscox as a Political Risks Underwriter.

The Hiscox love of art gets into everything we do. Not only do we insure art, we collect, sponsor and promote it. Hiscox enjoys uncovering and encouraging emerging talent, and has a collection including work by a strong selection of renowned international artists.

View the collection

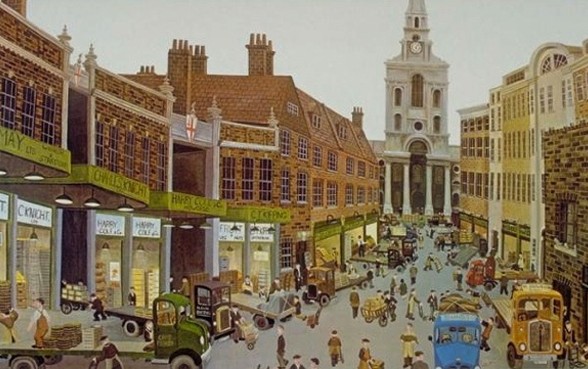

Image: John Allin, Spitalfields Market, 1974

Ian Nicholas Thomson joins the Hiscox Group in 1973. He is made Underwriter of Syndicate 33 from 1977 to 1993, when he became Director of Underwriting for the Hiscox Group.

In the 1970s, after a series of high-profile incidents, kidnap became a real danger for public figures and prominent business people, and the demand for insurance grew. Since then, Hiscox has become the world’s leading insurer against kidnap and ransom, with around two-thirds of the world’s premium income.

The threat of international terrorism and the potentially devastating consequences of indiscriminate violence present new challenges for businesses worldwide, where difficulty in distinguishing between the insurable perils has only increased over time. In response to the diverse nature of military conflicts across the world, Hiscox develop a war terrorism and political violence (WTPV) policy to protect against losses of physical damage and business interruption directly caused by acts of war, terrorism, sabotage and hostilities of a warlike nature, even if a war has not been declared.

Following the sudden death of Ralph Hiscox, Robert, aged 27, takes control of the partnership.