Why invest in Hiscox?

Hiscox is a uniquely balanced insurer with a clear vision for the future.

Pages in this section

Our strategy

A balanced business

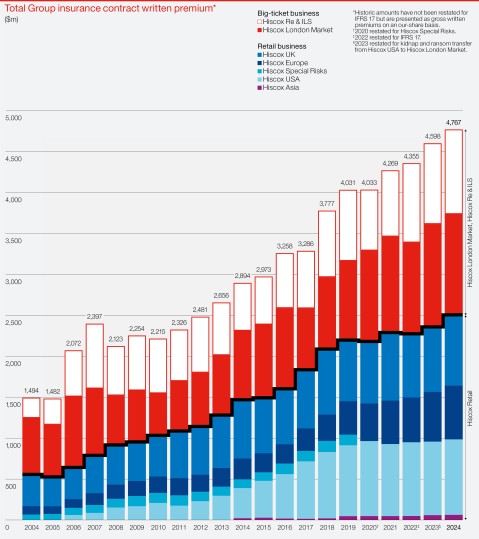

Hiscox comprises of our Retail, London Market and Re & ILS businesses. Each component faces unique opportunities and challenges, which informs the role that each will play in our future growth and success. However underpinning each component is our people, culture and brand, and a long-term investment in both underwriting and digital expertise.

Global reach

We are an international business, but we invest in local market knowledge and experience to truly understand the markets we operate in and provide relevant products and services. This gives us a unique breadth of expertise, serving customers from sole traders to multinational companies and ILS investors.

Specialist products

In every part of the Hiscox Group, we focus on providing products and services that differentiate us. These range from high-value home insurance and fine art – areas where we have deep foundations to build on – to small business, flood, and kidnap and ransom – where innovative products and service set us apart.

A focus on creating sustainable and compounding shareholder returns

By running a well-balanced business, underpinned by a clear set of values and characterised by a disciplined approach to underwriting, our aim is to consistently grow the business in a way that is organic, sustainable and profitable.

The Hiscox Group has:

- paid out $2bn to customers in claims in 2024;

- returned capital to shareholders of over $1.4 billion*;

- we currently lead on two-thirds of the London Market we write through Syndicate 33;

- third consecutive year of high employee engagement scores (82% in 2024).

*Includes share buybacks and all special, ordinary, and Scrip Dividends paid to shareholders since 1 January 2015. Excludes the final dividend proposed for 2024.

A resilient business

Strong underwriting discipline, a diversified strategy and sound capital management lead to a lower risk profile for the Group.

We underwrite for profit, not for market share, and we actively manage our business mix according to the conditions in each sector.

The Hiscox Group maintains strong and stable credit ratings: ‘A’ by A.M. Best and S&P. The Group remains strongly capitalised and is in a strong position to take advantage of future growth opportunities across our businesses.

Unique culture

The quality of our people is a crucial factor in our continuing success. Their expertise, courage and dedication drive our reputation for quality and professionalism. In return, we strive to provide them with a work environment in which they can flourish. Pulse survey participation in 2024 was consistently above 80%, and we are proud to have maintained an engagement score of 82% for the third consecutive year.

Find out more about our people

Strong brand

We have invested significantly over many years to build a recognised and renowned brand. Our distinctive marketing campaigns are developed from a deep understanding of our customers and positively contribute to consumer buying decisions.

Specialist expertise

We are market-leaders in many of the sectors in which we operate, while our commitment to provide clients with quick responses, clear coverage and superb service is at the heart of everything we do.

- In the USA, Hiscox small business customers rated us 4.7 out of five for customer service on Feefo*.

- In the UK, 94% of customers were satisfied with our customer service*.

- In Germany, 80% of customers said they were satisfied with our customer service*.

*all scores for 2024.

Aki Hussain, Group Chief Executive Officer

Hiscox is a uniquely balanced insurer with a clear vision for the future.