We have a rich heritage as experts in providing specialist insurance. Our timeline takes you on a journey through our history and what has made Hiscox the business it is today.

From a single underwriter at Lloyd’s in 1901 to 31 offices in 13 countries throughout the UK, USA, Europe and Asia.

This timeline tells the story of how Hiscox became the business it is today.

We have a rich heritage as experts in providing specialist insurance. Our timeline takes you on a journey through our history and what has made Hiscox the business it is today.

Following Ralph’s election as Chairman of Lloyd’s, Robert begins underwriting for Syndicate 33, focusing on personal accident and fine art. He develops the first specialist fine art account.

The day Hurricane (Billion Dollar) Betsy hits the US, Robert moves to join his father’s Syndicate 33 as a trainee underwriter.

Image: Robert meeting Prince Charles during a royal visit to Lloyd’s of London in the late 1960s.

After graduating from Cambridge University, Robert Hiscox joins a small Lloyd’s broker.

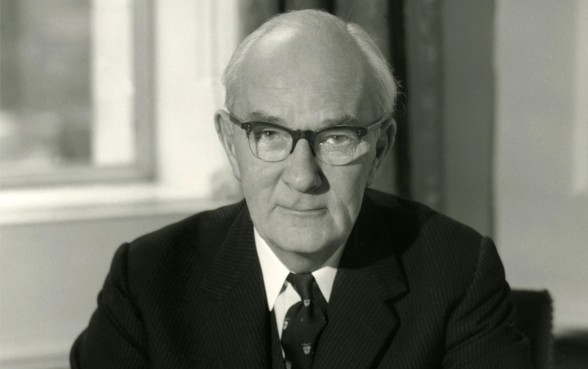

Ralph returns from the war and rejoins the Roberts family as a partner in the new partnership of Roberts & Hiscox.

On the outbreak of war in Sept 1939, Ralph leaves immediately to join the RAF and his syndicate (which had written premiums of £400,000 by then) is warehoused by the Robt Bradford agency until his return in 1946.

Ralph Hiscox joins the Roberts agency to start a non-marine syndicate for the 1939 account.

War is declared in Europe on the 28th July 1914. It lasts until 11th November 1918. During the Great War, hundreds of underwriters, brokers and members of Lloyd’s are called upon for their services.

Cuthbert Heath paved the way for a specialist policy for Zeppelin attacks, known as Zeppelin insurance, when the first airline insurance was only offered in 1911.

“Pay all of our policyholders in full, irrespective of the terms of their policies.” Cuthbert Heath

Following the San Francisco earthquake disaster the insurance industry looked for new advanced ways of building risk models helping to foresee and protect against the devastating effects of natural disasters.

Cuthbert Heath, the father of non-marine insurance as he is known, created some of the world’s first insurance policies against risks such as burglary, earthquake and hurricane. in 1887, Heath founded the brokerage CE Heath as well as his own insurance company, the Excess Insurance Company.

Hiscox traces its roots back to A E Roberts who was a marine underwriter at Lloyd’s for his own syndicate in 1901. Coincidentally, The Economic Insurance Company, which was acquired by Hiscox in 1996 and re-named The Hiscox Insurance Company, was also formed in 1901.

Image: The wedding of A E Roberts and Olive Luck, 27 July 1898

From a single underwriter at Lloyd’s in 1901 to 31 offices in 13 countries throughout the UK, USA, Europe and Asia.

This timeline tells the story of how Hiscox became the business it is today.