Hiscox climate report 2024 (html version)

This report includes information on our progress over the 12 months since our last climate report was published. The information contained in the pages that follow covers our climate-related activity between July 2023 and July 2024.

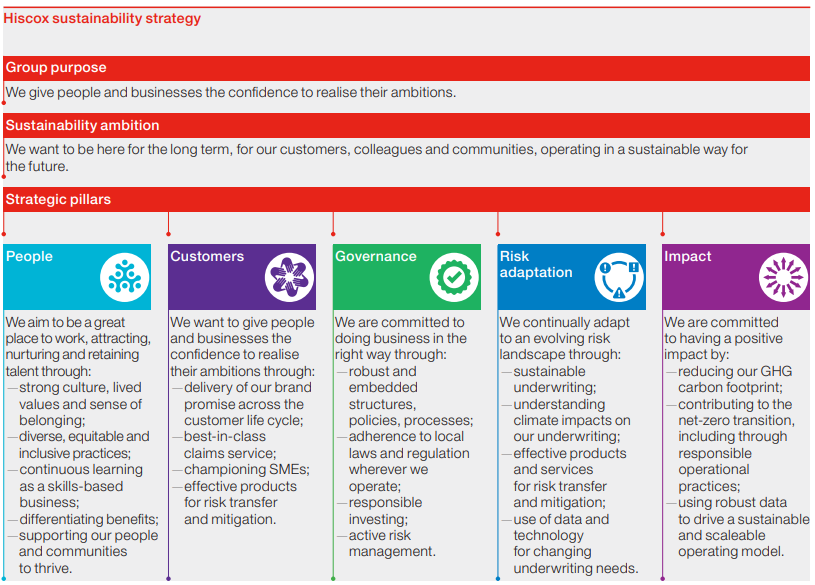

We take our role in the world seriously and want to play a responsible part in society, but we are pragmatic about what that looks like. We have established many of the structures, policies and processes that it takes to build a responsible business, but the sustainability landscape is rapidly evolving and so too must our approach. Our five strategic pillars – people, customers, governance, risk adaptation and impact – each represent important areas of focus for the Group. We want to be a great place to work, deliver exceptional customer experiences, adapt effectively to the changing risk landscape, do business in a responsible and ethical way, and play our part in the net-zero transition.

Climate change presents a major challenge that we take very seriously, because, as a global insurer and reinsurer, whose customers range from individuals to businesses of all shapes and sizes, including other insurers, almost every part of our business is affected by climate-related risks. This is why we are helping our customers and business partners to adapt through our products and services, and why we are evolving as regulatory obligations and external expectations change. It is also why we are a signatory to the Paris Agreement, which advocates collective action to limit global warming to less than 2˚C above pre-industrial levels this century.

Theme: Governance

Sub-Principle 1.1: Ensure that our Board has oversight of climate and nature-related risk and opportunity management, including any transition plans.

Hiscox have an established and embedded governance structure for climate and nature related matters, with robust and rigorous processes for identifying, measuring, monitoring, managing and reporting climate-related matters (including climate-related risks and opportunities) across the Group. This spans from an operational level up to the Sustainability Steering Committee (SSC), the Risk Committee of the Board, and the Board itself. Below is an overview of structure, membership, roles and responsibilities and frequency of meetings, including Management’s role in assessing and managing climate-related risks and opportunities. Climate-related responsibilities are embedded across Board and Management committees, and where appropriate within job roles. The Board has oversight, with the Group Chief Executive Officer holding ultimate accountability. This ensures that climate and nature action and ambition including any transition plans are driven by the Group’s senior leaders as well as by individuals with day-to-day management responsibilities. In 2024/25, we will seek approval from the SSC and the Board for our first Transition Plan ahead of publication. The SSC/Board is also responsible for approving policies such as our exclusions policy, environmental policy and human rights policy and other reports e.g. our climate report and TCFD report.

This structure is supported by other established roles and teams that contribute to our sustainability story. These include our employee-led networks including our green teams, our governance committees, and specific management groups such as our Natural Catastrophe Exposure Management Group. These areas are represented in elements of this structure, more detail can be found in later sections of the report. The Board is responsible for climate related issues and as part of continued development of the Board level knowledge and awareness of climate related issues we have added climate expertise to the requirements for future Board members.

Board

- Oversight of long-term sustainability vision, strategy, priorities and performance against agreed metrics and targets.

- Ensures governance and accountability is in place with sufficient support.

- At least quarterly discussion on relevant topics for example our sustainability strategy, trends, opportunities, vulnerabilities, and emerging issues.

- Receives training on key sustainability issues previously; the ESG regulatory landscape, anti ESG sentiment, ESG underwriting risks and opportunities. Forward looking training topics include transition planning guidance and nature and biodiversity impacts.

Risk Committee

- Advises the Board on sustainability strategy, key priorities, risk profile, risk exposures, risk appetites and opportunities.

- Recommends proposals for consideration by the Board as required.

- Group Risk and Capital Committee (GRCC)

- Quarterly reporting on ESG matters from the Sustainability Steering Committee.

- Group Executive Committee (GEC)

- Periodic ESG training sessions.

- Sets business unit or function ESG-related strategy and priorities and drives delivery through business units and functions.

- Audit Committee

- Regular updates on progress against the strategy

Sustainability Steering Committee (SSC)

- Sub-committee of the GRCC, responsible for execution of the agreed ESG strategy, overseeing actions and delivery at a Group level.

- Typically meets quarterly and embeds sustainability risks and opportunities.

- Oversees effective use of resources and tracks Group and entity-level sustainability performance.

- Ensures senior management-level involvement and accountability for sustainability issues, with senior representation from areas including underwriting, investments and operations.

- Approves ESG related policies ahead of Board approval.

Sustainability working group

- Operational body, providing central point of coordination and expertise for ESG-related activities across the Group.

- Manages ESG-related Group reporting, disclosures and communications.

- Meets monthly and provides input and recommendations to management on ESG matters.

- Focuses on ESG-related research, including external monitoring and expectations.

Sub-Principle 1.2: Ensure that our senior management has responsibility of climate and nature-related risk and opportunity management, including any transition plans.

In 2023, we created a new Sustainability Manager role for the Group, to further enhance our coordination of sustainability and climate-related activities across the business and drive progress. Embedding this role within our business has been a key focus for 2024 to ensure climate and any nature related commitments and objectives set by the Board and SSC are integrated into our operations.

We also reviewed our sustainability strategy in 2023 in line with our own ambitions, considering our most material sustainability issues. The new Group sustainability strategy, outlined below, has sharpened our focus on the areas that matter most to our business – our people, our customers, governance, risk adaptation and impact – but crucially it has also enhanced management ownership and accountability for sustainability issues as we now have a member of the GEC leading each pillar. The risk adaptation and impact pillars are of relevance to climate issues and transition planning.

The governance pillar is owned by the Group Chief Risk Officer creating a direct link to the Groups risk management processes and the people pillar owned by our Chief People Officer. The risk adaptation and impact pillar are owned by our Group Chief Underwriting Officer who is also a Board member and our Chief Operations and Technology Officer respectively, this supports ensuring our most material areas are focusing on the transition to Net Zero and developing climate and nature mitigation innovation where possible. The customer pillar is owned by the UK CEO who is also a member of the ClimateWise Advisory Board. Creating these lines of ownership is key to driving progress within these broad areas of the business.

In our UK legal entities, the governance structure is bolstered by the appointment of senior managers with overall regulatory responsibility for managing the financial risks from climate change, in line with the UK’s Senior Managers Certificate Regime (SMCR). This includes our Group CEO who is chair of the Sustainability Steering Committee. Where applicable team members across the business have sustainability related objectives embedded in their personal objectives. As climate and nature risks and opportunities become further embedded in our business, and regulatory requirements continue to evolve, we may consider whether a similar approach to the UK is required in other parts of the business in the future.

Sub-Principle 1.3: Create a clear link between governance and oversight, establishing a robust governance framework and underlying policies and procedures.

The Sustainability Steering Committee is chaired by the CEO and is designed to ensure frequent senior management oversight of ESG and climate and nature-related issues and their actual or potential impact on business performance and the external environment both now and longer term. The SSC is made up of senior executive and management in the business and meets at least quarterly, but documentation can be shared for consideration in between these meetings. In addition, a meeting can be held outside of the quarterly programme if required. The SSC approves or discusses items such as;

- discussion and approval of our materiality assessment and our new sustainability strategy

- discussion and approval at the SSC of the underlying sustainability plans to achieve our strategic ambition;

- annual review of the ESG exclusions policy and the responsible investment policy, coordinated by the sustainability working group (and, in the case of the responsible investment policy, the Group Investment team) and approved by the SSC;

- meetings with catastrophe model vendors to discuss latest modelling developments, led by our catastrophe modelling team, which contribute to the work of the Natural Catastrophe Exposure Management Group by constantly evolving our climate modelling approach

- development of an overarching Group Climate Action plan is in progress, this will support the ‘climate action plans’ in our UK legal entities, which are a standing agenda item at the SSC to ensure full governance oversight. During 2023, the UK legal entity plans were the subject of a comprehensive review and embedded actions moved into ‘business as usual’ activities.

- development of a code of conduct for our employees that ensures clarity around the expectations of policies, practices and behaviours that matter to us as a business as we grow, including health and safety, data privacy and security, responsible environmental practices and avoiding financial crime such as bribery and corruption.

- approval of our Human Rights Policy and Modern Slavery Statement.

Forward looking for the remainder of 2024 into 2025 the aim is for the SSC to review, and where appropriate approve the following:

- impact assessment regarding nature and biodiversity with the aim to agree next steps.

- our first group climate transition plan with the aim to provide feedback, agree next steps and approve final plans.

- our environmental policy and business travel policy to agree updates and approve.

- our annual climate report for publication.

In 2024 a regular reporting pack was developed to ensure consistency in reporting to the SSC and to show progress over time with the objective of improving knowledge and understanding across the business. This pack includes progress against our sustainability strategy and plan, a KPI (key performance indicator) dashboard of KPIs or KRIs (key risk indicators) we currently measure and ones we aim to develop and a regulatory horizon scanning tracker. This will be reviewed and monitored for its effectiveness annually.

As a regulated entity Hiscox is required to maintain an effective Risk Management Framework (RMF). The RMF Policy and the associated risk policies capture how Hiscox manages its risks within the framework. Compliance with the risk policies is essential to ensure overall regulatory compliance with risk management requirements. Therefore, this is not new to us, how we integrate climate, nature and environmental factors is an area we are developing. We have a range of policies that hold us to account when it comes to these matters, some of which are set out below. As part of developing our approach and continuing to embed sustainability including climate and nature management across the business, a review of all policies will be conducted in the second half of 2024.

Our policies:

Environmental policy

Our environmental policy outlines our approach to managing the environmental impact of our business activities and those that arise from our ownership and occupation of office premises. We actively manage and aim to minimise our environmental impacts, the resources we consume and the amount of waste our activities produce, as well as complying with relevant environmental legislation and other commitments such as the ClimateWise Principles and developing a transition plan to enhance the progress we make reducing our impact. We share the policy with suppliers and partners as required. This policy will be reviewed and updated in 2024.

ESG exclusions policy

(Re)insurers have a role in ensuring an orderly transition to a low carbon economy and we want to play our part. Our Group-wide exclusions policy, which officially came into effect from 1 January 2022, outlines how we intend to do this. Ultimately our ambition is to phase out (re)insurance of thermal coal-fired power plants and thermal coal mines, Arctic* energy exploration activities and oil sands by 2030, in line with the 2015 Paris Agreement and UN Sustainable Development Goals. Although this policy only came into force officially in January 2022, we were already starting to embed it into our business during 2021 and declining risks on this basis. This policy has been designed to contribute to the insurance industry’s role in supporting the transitioning economy, and aligns to the Lloyd’s ESG ambitions published in December 2020. It supports our wider sustainability activity, including our annual cycle of carbon reporting and offsetting, and our emissions reduction programme.

- No longer provide new insurance cover to thermal coal-fired power plants, thermal coal mines, Arctic* energy exploration activities, oil sands or controversial weapon.

- Not directly invest into securities of companies that generate more than 10% of revenues from thermal coal extraction or power generation, Arctic* energy exploration activities, oil sands or controversial weapons.

- No longer reinsure portfolios where 30% of the premium base derives from thermal coal-fired power plants or thermal coal mines, Arctic* energy exploration activities, oil sands or controversial weapons.

Progress against our exclusions policy since development includes

- System changes to allow us to start to categorise big-ticket risks by ESG status.

- Created new underwriting dashboards that provide live views of our exposure to excluded sectors.

- Started to decline underwriting risks that fall outside of appetite.

- Shared the policy with our fund managers, to ensure it is considered in relation to pooled funds.

- Eliminated our investment exposure within all directly held bonds that fall outside of appetite.

- Reduced our exclusions threshold for our investments from 30% to 10% of direct investment.

*Arctic National Wildlife Refuge (ANWR) region.

Supplier code of conduct

We want to work with like-minded businesses who align with our values and support our goals. Our supplier code of conduct, which we published during 2022, sets out the behaviours and standards we expect from all suppliers providing goods and services to or on behalf of Hiscox, and any third parties subcontracted by our suppliers. Any supplier that has any commercial dealings with Hiscox, including brokers, cover holders, third-party administrators, outsourced service providers and specialists, and any of their subcontractors must state compliance with this code of conduct.

Health and safety policy

Our health and safety policy helps ensure we provide a work environment and activities that ensure the health, safety and welfare of all our employees and those who are affected by our operations across all Hiscox Group activities and locations. We provide annual health and safety training to all employees and track and monitor incidents reported to us.

Modern slavery statement

Hiscox complies with the provisions of the Modern Slavery Act. Our modern slavery statement outlines our zero-tolerance approach to slavery or human trafficking in our supply chains or in any part of our business. In 2024 we worked with an external third party who specialises in this topic to improve our Modern Slavery statement, from this work we have taken some actions which are publicly available in the statement to continue to improve our risk management.

Human rights policy

We are guided by the principles of the UN’s Universal Declaration of Human Rights and the International Labour Organisation’s core labour standards. As a Group, we are committed to respecting and protecting human rights in every part of our operations, supply chain, and within the communities we serve. We recognise that our activities may have direct or indirect impacts on the human rights of our employees, customers, brokers, suppliers, contractors, business partners, investors, and other stakeholders. Equally, we know we have a responsibility to use our influence and leverage to prevent or mitigate any adverse human rights impacts that are linked to our business, and we take these responsibilities seriously. This policy is one that is new for Hiscox for 2024 and actions have been developed to continuously improve our risk management in this area.

Responsible investment policy

We have a Board-approved responsible investment policy and an ESG exclusions policy which applies Group-wide, and these policies work together to ensure our approach to climate is reflected in our business strategy and most importantly in how we operate day-to-day. Our responsible investment policy, in conjunction with our Group ESG exclusions policy, sets out the principles applied to our portfolios and ensures ESG considerations are considered in our external manager selection and monitoring processes. The policies also guide our selected external asset managers, setting out our expectations of how ESG issues and opportunities should be incorporated into their investment and ownership decisions undertaken on our behalf, while ensuring reporting and disclosure of ESG issues and engagement activities.

Many of our portfolios are directly invested, and our investment guidelines with our selected investment managers include requirements to incorporate material ESG factors into their investment and stewardship activities and to abide by our ESG exclusions policy. The exclusions policy states our intention to not directly invest into securities of companies that contribute disproportionately to climate change or are involved in undesirable practices, these include those that generate more than 10% of revenues from thermal coal extraction or power generation, Arctic energy exploration activities, oil sands or controversial weapons. Where Hiscox invests in pooled funds and has no direct control over portfolios, desired exclusions are shared with the investment manager, and they are requested to apply them wherever possible.

Sub-Principle 1.4: Ensure that our Board and Senior Management have the required knowledge and incentives to oversee risks and establish a culture aware of environmental issues.

The Limited Board and GEC have annual training on the broad topic of sustainability and information is shared with the Board via our governance structures. Previous trainings include the “sustainability regulatory landscape” and “anti-ESG sentiment”. In 2024 we are focusing on enhancing the Board’s knowledge of the intricacies, risks and potential opportunities from sustainable underwriting, this encompasses many topics such as nature e.g. deforestation and governance issues such as human rights. We may share this training with other relevant Boards across the business, for example the HSA Board and EMT ahead of developing our approach to Corporate Sustainability Related Disclosure (CSRD) regulations.

Providing continuous learning opportunities for our people also remained a significant focus in 2023 with 66 of our colleagues enrolling in the Hiscox Data Academy, an apprenticeship programme focused on increasing the data literacy of employees, and seven benefitting from our finance apprenticeship programme to support them in achieving their ACA qualification. All our people have access to our learning management system for personal development and technical training, and in 2023, our people completed over 44,000 hours of training worldwide – that’s almost 15 hours per person. We also provide on-the-job training, for example through our established internship and graduate programmes, where we continue to target a diverse pool of students.

In alignment to sustainability there is mandatory training for all employees as part of the programme of mandatory training and an overview of the strategy and how we manage sustainability included in the new employee packs. Employees are encouraged to partake in training as and when is appropriate for them and a budget for each employee is allocated for training to support this. An example of recent sustainability aligned training is, a senior member of the investment team has passed the CFA Certificate in ESG Investing, other team members participated in climate training provided by Columbia Climate School, in conjunction with one of our investment managers.

In 2022-23 we conducted a comprehensive remuneration policy review to ensure that our Executive remuneration fully supports the achievement of our strategic objectives and motivates continued high performance on behalf of shareholders – including our financial results but also our wider role as a responsible employer, insurer and corporate citizen. Following the review non-financial performance measures were introduced under our incentive plans for the first time. The introduction of these measures is designed to align with good remuneration practices among UK-listed companies, and appropriately reinforce our ESG responsibilities. The measures consisted of employee and customer engagement metrics. In 2024 we reviewed the opportunity to add more non-financial KPIs aligned to decarbonisation, however the decision not to include ESG at this time was taken. The reason for this decision was centred around the quality of the data related to Scope 3 operational measures and using scope 1 and 2 was not deemed stretching enough. We will instead review the approach to LTIP metrics during our Remuneration Policy renewal in 2025 for 2026 implementation, with the intention to include climate-related metrics form part of the non-financial performance measures.

Theme: Strategy

Sub-Principle 1.5: Describe the impacts and implications of climate- and nature-related risks and opportunities on our business model and performance, strategy and any decision-making processes.

As described in section 1.2 we recently created a sustainability strategy with five strategic pillars – people, customers, governance, risk adaptation and impact – each represent important areas of focus for the Group. We want to be a great place to work, deliver exceptional customer experiences, adapt effectively to the changing risk landscape, do business in a responsible and ethical way, and play our part in the net-zero transition. Activities, progress and oversight of each pillar will continue to be driven through our embedded sustainability governance structures, under GEC leadership. Our new sustainability manager role sits within the Group Strategy function creating a direct link into our Group strategy. The strategy will be reviewed annually as the understanding of our impact develops, for example, an assessment of our impact on Nature and Biodiversity is to be carried out in 2024/5, with the aim to reflect any material outcomes in our strategy going forward.

Climate-related risks and opportunities are identified and either progressed or managed and mitigated in much the same way as any other risks and opportunities facing the Group. Those risks and opportunities are embedded into the strategy either through the modelling we do and there by adjustments we make to avoid climate risk impacts or by the product development opportunities seized. The relevant structures involved in identifying climate-related risks and opportunities are outlined in section 1.1. Our impact on nature and biodiversity will be assessed during 2024, following this assessment the actions to mitigate, manage and monitor will be embedded into our current processes.

Climate risks and opportunities

We consider the potential impact from climate-related issues over a range of time horizons.

Near-term climate risks and opportunities (0-5 years).

- Increased claims may result from more frequent and more intense natural catastrophes, such as floods and storms, due to climate change. These claims will not only come from damage to property but also from other knock-on effects, such as global supply chain disruption or scarce resources. However, given most of the policies we write are annual (re)insurance policies, we can adjust pricing and appetite accordingly.

- There are financial risks which would arise from the transition to a lower-carbon economy, such as a drop in the price of carbon-intensive financial assets. Our ESG exclusions policy, which will see us reduce our exposures to the worst carbon emitters in both underwriting and investments, prepares us for this – as does our new GHG emission reduction targets.

- We are looking at opportunities in renewable energy where we are supporting several major wind and solar energy projects; and in the decommissioning of offshore carbon assets which is an area we insure. These are just some examples of lines of business where we could see increased opportunity over time, and in some cases we are already benefiting from changing customer trends. An example of this is US flood, where demand is growing and our product offering, use of data and technology means we are well placed to serve more customers with flood cover.

Medium- to long-term climate risks and opportunities (5+ years, up to 2050).

- Climate-related risks have the longer-term potential to impact regulatory risk, credit risk, legal risk, reputational risk, and technology risk. We have several emerging risks forums across the organisation which are designed to identify emerging, longer-term risks and opportunities, including climate-related risks and opportunities. Alongside our in-house modelling and research expertise, these groups ensure our work considers climate-related issues over a range of business planning time frames.

- There is also the longer-term risk that those who have suffered loss from climate change might then seek to recover those losses from others who they believe may have been responsible. Where such claims are successful, those parties against whom the claims are made may seek to pass on some, or all, of the cost to insurance firms through policies such as professional indemnity or directors and officers’ insurance.

- While in the long term as a property casualty insurer, Hiscox is certainly exposed to climate-related risks, we believe our exposures can be managed through time because of how we conduct our business. For example, through the flexibility we have in our predominantly annual underwriting contracts, and through the liquidity of our investment portfolio which lends itself to constant adjustment. This flexibility is our key tool for managing the multi-decade challenge of climate risks holistically.

We are continuously developing products that are necessary for our customers in the short, medium and long term and that consider changing needs including in relation to a changing climate. What that looks like varies by business area; for example, through our participation in Flood Re in the UK, we are better positioned to provide flood insurance to some clients that are in high-risk flood areas, and in the USA our FloodPlus products similarly improve market access to affordable flood cover. Hiscox UK flood insurance In UK retail, where our climate-related exposures are relatively low, we have been supporting homeowners and small businesses with effective flood insurance for several years. As such, we are a longstanding participant in Flood Re, the government-backed scheme designed to improve both the access and affordability of flood insurance for high-risk properties. Through our participation in Flood Re, we also support the ‘Build Back Better’ provision introduced to Flood Re in 2022. This provision enables customers to access further funds, above reinstatement costs, after a flood to install flood resilience measures that are designed to reduce the cost and impact of future flooding.

Sub-Principle 1.6: Describe how environmental resilience plans are incorporated into business decision making, including disclosure of any material outcomes of climate risk scenarios.

The broader governance and risk management structures we have in place are critical to the delivery of the annual Group operating plan and ensure a coordinated approach to climate resilience and other issues across the Group. These structures are supported by investments in technology – to ensure the right modelling and data are available to support our pricing and exposure – and by in-house expertise – where we combine off-the-shelf climate views with our own claims expertise and insight to form a unique view (what we call the ‘Hiscox view of risk’). We consider the potential impact from climate-related issues over a range of short-, medium- and long-term time horizons. We consider short term to be 0-2 years, medium term to be 2-5 years, and long term to be five years and over, which aligns with some of our business planning timeframes. While in the long term as a property casualty insurer, Hiscox is certainly exposed to climate-related risks, we believe our exposures can be managed through time as a result of how we conduct our business. For example, through the flexibility we have in our predominantly annual underwriting contracts, and through the liquidity of our investment portfolio which lends itself to constant adjustment. This flexibility is our key tool for managing the multi-decade challenge of climate risks holistically.

We also conduct our own in-house stress testing and scenario analysis and contribute to industry events which can help us manage the risks related to climate impact. While there was not an industry-wide exercise in 2023, in 2022 Hiscox Syndicate 33, Syndicate 3624 and Hiscox Insurance Company (HIC) participated in the Bank of England’s General Insurance Stress Test (GIST). The objectives of the GIST 2022 exercise were to assess resilience to severe but plausible natural catastrophe, as well as cyber scenarios, to gather information about firms’ modelling and risk management capabilities and to enhance the PRA’s and firms’ abilities to respond to future shocks. While the exercise did not aim to assess the financial impact specifically from climate change, the climate-related (atmospheric) scenarios it explored – US hurricanes, European/UK windstorms and UK flood – represented severe but plausible realisations of current climate conditions chosen to reflect firms’ exposures and business models. Industry-wide stress tests such as the GIST support our established and embedded programme of internal stress testing and scenario analysis and contribute to their continued evolution.

Our natural catastrophe team uses catastrophe models, paired with atmospheric models, that are created with the latest IPCC science to achieve a quarterly risk review of Hiscox ‘s exposure to peril impacts. The team’s work also results in a one-year forward-looking model of relevant natural catastrophe risks, which reflects the fact that the majority of the policies we write are annual in nature, and supports our ability to rapidly respond to emerging trends as required. The team includes historical claims data in the model to produce a realistic likelihood of risk exposure to Hiscox, and alongside other functions this work contributes to the development of UK entity level climate action plans which are reviewed and approved at both entity-level and through the SSC. One example of how an identified risk has been managed with the help of the natural catastrophe team relates to Japanese typhoon risks, where through modelling we identified changing typhoon patterns in terms of both size and intensity, which we were then able to reflect in how we price this particular business.

Sub-Principle 1.7: Describe the outcomes of our materiality analysis and any material climate- and nature-related risks and opportunities that affect our prospects.

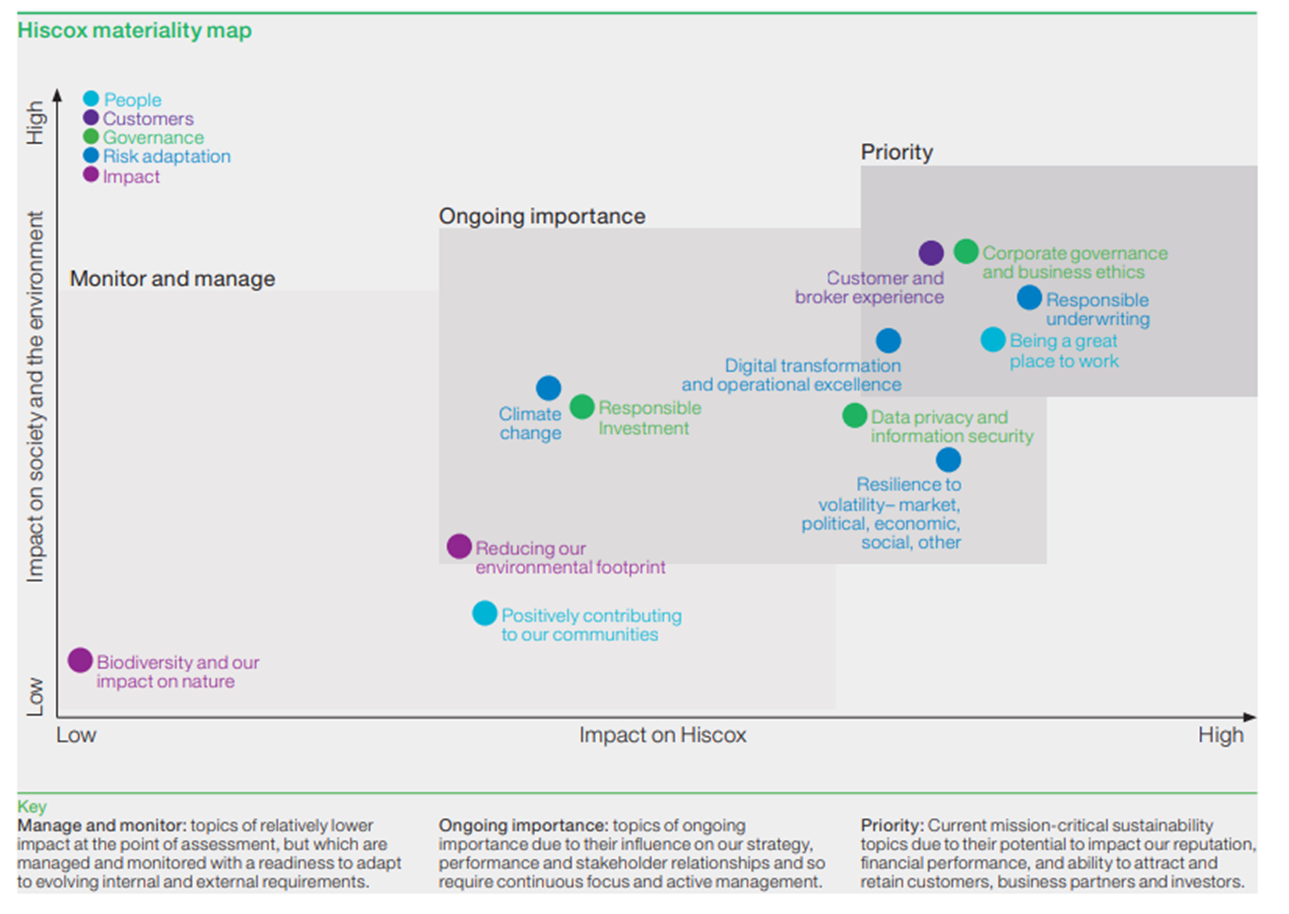

We continue to enhance our understanding of the material sustainability issues facing our business, and in 2023 we conducted a double materiality assessment to help us identify the most pressing sustainability topics we need to address, as well as the issues and opportunities of rising importance, and in support of emerging regulatory requirements including CSRD and ISSB’s IFRS S1 and, to a lesser extent, S2.

Double materiality assessments are increasingly common practice: they are used by companies to help shape sustainability strategies, and by external consumers including investors to understand company thinking on sustainability – including areas of potential risk and significant opportunity. They look both outwards at our impact on people and the planet, such as our GHG emissions, and inwards at the impact of specific issues on our business, such as the effects of climate change on the frequency and severity of extreme weather events and, as a result, our claims experience. We aim to continue to improve our approach to materiality assessments starting with nature and biodiversity in 2024, where we have sought external support to develop.

The output of our assessment aligns with our current strategic and business priorities, we expect to see movement in this assessment as we begin to understand more about each topic and embed sustainability across the business. There is a risk that we have not given enough priority to certain areas and too much to others, therefore the assessment is reviewed and challenged regularly.

Theme: Risk Management

Sub-Principle 1.8: Establish appropriate processes to identify, assess and prioritise climate and nature-related impacts, risks, and opportunities.

As a regulated entity we have a good understanding of managing risk and maintaining a strong risk culture across the organisation is recognised as a key component of effective risk management at Hiscox. We activate the three lines of defence model:

Own risk and controls

Responsible for ownership and management of risks on a day-to-day basis. Consists of everyone at every level in the organisation, as all have responsibility for risk management at an operational level.

Assesses, challenges and advises on risk objectively

Provides independent oversight, challenge and support to the first line of defence. Consists of the Group risk team and the compliance team

Provides independent assurance of risk control

Provides independent assurance to the Board that risk control is being managed in line with approved policies, appetite, frameworks and processes, and helps verify that the system of internal control is effective. Consists of the internal audit function.

While there are certain nuances to climate risk, we consider it to be a cross-cutting risk with the potential to impact each existing risk type rather than a stand-alone risk. We look at how climate interacts with different risks and whether this may result in correlations or concentrations of exposure that we need to know about, monitor and manage. Climate-related risks, among other major exposures, are monitored and measured both within our business units and at Group level. By design, our Group risk management framework provides a controlled and consistent system for the identification, measurement, mitigation, monitoring and reporting of risks (both current and emerging) and is structured in a way that allows us to continually and consistently manage the various impacts of climate risk on the risk profile.

Our risk and control register, risk and control self-assessment process, and risk policies include relevant climate considerations against each of our existing risk types, including our key risks. Therefore, climate-related risk drivers are not considered a single risk factor but are assessed and recorded against the risks on our risk and control register. We have developed a climate risk appetite statement for the Group, which articulates our risk appetite when it comes to climate and guides our approach to climate risk. The climate risk appetite statement was formally approved by the SSC and during 2023 we undertook further work to measure and track our climate-associated risks where such risks are modelled and where the Group has the capabilities required to manage them. This work will continue to be a focus during 2024.

Our Risk Committee is responsible for assessing the climate-related risks and opportunities we face. It advises the Board on how best to manage the Group’s risks, by reviewing the effectiveness of risk management activities and monitoring the Group’s actual risk exposure. The Risk Committee relies on frequent updates from within the business, including those arising from the management committees and working groups that report up through the Risk Committee, and from independent risk experts for its understanding of the risks facing both our business and wider industry. As our understanding of our impact on nature and biodiversity develops our current processes will develop to include management of the risks and opportunities.

The GUR is a Group management committee focused on assessing progress against the Group’s strategic underwriting priorities, reviewing and challenging the Group’s underwriting portfolio and loss ratio performance, and approving key underwriting risks. It also serves as an escalation point for underwriting governance and control issues. The committee meets at least five times a year, is chaired by the Group Chief Executive Officer, and attended by other senior leaders including the Group Chief Financial Officer, Group Chief Underwriting Officer and the Group Chief Risk Officer – with experts invited from actuarial, claims, underwriting risk and reinsurance. A number of working groups feed into the GUR, including some with particular climate relevance such as the Natural Catastrophe Exposure Management Group and the Casualty Exposure Management Group, which considers among other things risks associated with climate litigation.

The Natural Catastrophe Exposure Management Group reviews natural catastrophe risk at least quarterly. This group is chaired by the Group Chief Underwriting Officer and attended by other Hiscox senior managers responsible for catastrophe-exposed business. This group looks at the risk landscape, exposure monitoring and capital modelling for climate-related perils, and recommends, based on the latest observations and scientific knowledge, which models should be used for each peril, and, if necessary, how they should be adapted to reflect our best view of the risk. They also identify new areas of risk research. The models are reflected with changes to Hiscox’s modelling policy, historical claim data and all of our research prioritisations.

Casualty Exposure Management Group develops and manages the systemic risk that may arise in our casualty portfolio. Extreme loss scenarios are run to better understand and manage the associated risks throughout Hiscox. The risks that the team review include possible climate litigation covering topics such as greenwashing, energy litigation and misstatement of disclosures. There is potential exposure in all business units, particularly in our London Market business in areas such as general liability, marine and energy liability and D&O. The team continues to track developments in climate cases, new legislation and corporate reporting requirements to understand potential risks, and these are considered when setting business plans across the Group.

Hiscox Investment Group (HIG) although responsibility for governance ultimately sits with the Hiscox Board and its committees, which approve our Responsible Investment Policy. We have established structures both from an investment and an ESG perspective to ensure appropriate oversight of responsible investment issues. This Responsible Investment Policy is implemented within Hiscox’s investment portfolio by our in-house investment team, under the supervision of our main working committee, the Hiscox Investment Group (HIG). The HIG also draws on the work of our ESG working group, overseen by our Sustainability Steering Committee, that ensure appropriate oversight of ESG issues.

Group Risk and Capital Committee (GRCC) is a Group Management committee focused on risk and capital management. It covers all types and categories of risk, including but not limited to underwriting, reserving, market, credit, operational and strategic risk as well as risk aggregation, concentration and dependencies. The committee meets four times a year, is chaired by the Group Chief Executive Officer, and attended by other senior leaders including the Group Chief Financial Officer, Group Chief Underwriting Officer, Group Chief Risk Officer, and the Group Head of Capital Management – with other experts invited from across the business as required. Several committees feed into the GRCC, including some with climate relevance such as the SSC and the Grey Swan Group. The Grey Swan Group Grey swan risks are defined as being those risks with a potentially large impact, but a low perceived likelihood of happening. Therefore, the focus of the Grey Swan Group is to consider various enterprise emerging risks identified from across the business and to provide a forum for discussion to ensure Hiscox has the relevant ‘grey swans’ identified and the right actions in place to address them. Several elements feed into this process, including enterprise emerging risk scanning; regulatory horizon scanning; casualty exposure management; strategic and business planning; claims and actuarial reserving; and any other relevant business unit or function inputs. Rapidly evolving expectations on company’s responses to sustainability and climate change are considered as part of this group, in addition to other matters unrelated to sustainability or climate change. The risk management processes we have established and embedded for climate-related matters feed into the annual review of the operating plan, the long-term strategy planning process, forward-looking assessment scenarios, stress tests, and reverse stress test scenarios.

Sub-Principle 1.9: Put in place mechanisms to monitor and manage climate and nature-related risks and opportunities.

Exposure management

The Natural Catastrophe Exposure Management Group's activity enables us to develop the Hiscox view of risk (HVoR). The HVoR is constructed through a combination of the results of our own research, as well as comparisons with actual loss data, vendor modelling systems with adjustments made where we believe the models could be deficient. The overall aim is to generate a representative model of real-world risk. The HVoR defines the most significant climate-change-related risks and attempts to account for the latest scientific understanding of climate change. For example, we have worked to quantify the impact of climate change on Asian typhoon and US wildfire perils, to understand recent major events in the context of a changing climate. The Hiscox governance process ensures that underwriter decisions are checked for compliance with our latest policy. We are lining up the next perils to quantify a climate change view of risk, using our climate change framework, and plan to investigate the strength of the climate signal compared to the noise in climate variability. That assessment will in future occur with every new view of risk. Real-world claims data is monitored, and results fed back into the system to close the loop and continue to improve accuracy. Hiscox licenses several different natural catastrophe risk models. We believe that out-of-the-box models should only be used as a starting point when measuring risk, and as such the models we use are evaluated and assessed in terms of how they apply to our business before implementation. We created a risk map to combine exposures with each peril’s sensitivity to global temperatures and compare that to the strength of the climate change signal to come up with a list of perils and regions that are either: urgent and actionable, urgent, or actionable. Through the framework, we were able to focus our efforts onto two regions: US wildfire and Pacific typhoon. With every view of risk project we undertake, we assess the latest science and update the climate change framework to help determine if we need to adopt a climate change view of risk for each peril. We have actively developed and improved our assessment of climate liability risk since the 2021 CBES exercise. Our process involves:

- consistent research and monitoring of the legal environment with respect to climate change litigation, including pending insurance coverage cases;

- automatic tracking of new cases and legislation;

- regular internal reporting through briefings and white papers;

- discussions via emerging risks forums and the exposure management group meetings about policy wordings, exposure and mitigation options;

- and quantification of risk via RDS’s and exposure assessments.

Our assessment suggests we meet or are within one level of our target risk maturity for each entity risk maturity is highest for Syndicate 33 where our exposure to climate change is greatest, we are working to bridge the gaps for the lower materiality entities. The driving factors behind the assessment include the following: research and tracking of climate litigation, legislation, and regulations; identification and tracking of climate threats and opportunities; dedicated headcount for climate research and market forums; mitigation efforts (pricing, wordings, and reinsurance); exposure measurements and quantification; and sophistication of internal and external reporting processes.

Investments

We maintain a relatively small in-house investment team, which oversaw financial assets and cash totalling $8 billion as at 31 December 2023, investing mainly in bonds, cash and equities on behalf of the Hiscox Group. All of the team have ESG integration into the Group’s investment practices as personal objectives, which are reviewed regularly as part of our staff performance appraisal processes, alongside the ESG training programmes we have in place for our senior team members. This includes members of the team gaining the CFA Certificate in ESG Investing. Located in London, the team is charged with optimising Hiscox’s investment portfolio in line with its policies and targets. The priority for the investment portfolio is always to provide liquidity to pay claims and capital to support the business, and a conservative stance ensures that we remain in a good position to fulfil both roles. The secondary objective is to maximise our investment result in the prevailing market conditions subject to a prudent risk appetite Hiscox outsources the management of the Group’s investment assets to a range of specialist third party asset management experts and investment managers, who deal with securities and stock selection on a day-to-day basis and manage the investment risks on our behalf. However, the investment team retain the primary fiduciary duty to protect and enhance the value of our assets. This includes protecting against the investment risks and capitalising on opportunities resulting from climate change and broader ESG related issues.

Hiscox expects its asset managers to invest in companies that have sound ESG practices. Organisations that understand and successfully manage material ESG factors and associated risks and opportunities tend to create more resilient, higher-quality businesses and assets, and are therefore better positioned to deliver sustainable value over the long term. Those companies that do not have such controls are considered less suitable for investment. Regular reporting and annual reviews of, and engagement with, external managers on their ESG approaches helps ensure that the applicable ESG integration methodologies represent best practice and are consistently applied. An in-depth evaluation of ESG capabilities and credentials also forms an integral part of Hiscox’s manager selection process.

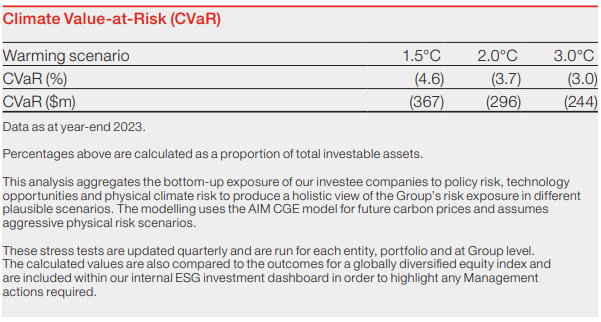

Whilst the above applies to our core segregated bond portfolios, we continued to assess how we could apply our GHG targets where we have investments in pooled vehicles and have had discussions with pooled fund managers on how to persuade them to adopt similar targets. We continue to work with our investment managers to expand their reporting of ESG factors and reporting on their compliance with our requirements. We continue to develop our ESG dashboard covering a wide range of ESG metrics in addition to our GHG targets. The dashboard is based on the recommendations of the Investment Consultants Sustainability Working Group (ICSWG), but we have added to this to expand the range of metrics covered. Our investment portfolio monitoring includes key metrics which were enhanced in 2023 to include more time series exhibits and greater granularity of net-zero alignment, including a broader range of indicators, e.g. scenario analysis is drawn out by our measurement of the CVaR (climate value at risk) of our investment portfolio. Depending on the metric, these are measured in absolute terms and versus a global equity index for comparison. The dashboard is updated quarterly and can be viewed at entity, investment manager or individual portfolio level. We use the investment manager mandates to ensure that our ESG practices are being adhered to.

Underwriting

Our Group-wide exclusions policy, which officially came into effect from 1 January 2022, supports us to manage the risks associated to our underwriting portfolios. Ultimately our ambition is to phase out (re)insurance of thermal coal-fired power plants and thermal coal mines, Arctic* energy exploration activities and oil sands by 2030, in line with the 2015 Paris Agreement and UN Sustainable Development Goals. This policy has been designed to contribute to the insurance industry’s role in supporting the transitioning economy and aligns to the Lloyd’s ESG ambitions published in December 2020. It supports our wider ESG activity, including our annual cycle of carbon reporting and offsetting, and our emissions reduction programme. These are risks that occur predominantly in our London Market and reinsurance business.

We have also engaged with data providers to understand the sustainability landscape of our portfolios and support building a credible picture for the SSC and risk committees to enhance decision making. We are focusing our attention on climate mitigation and risk adaptation with the development of products and through our ESG sub syndicate.

Sub-Principle 1.10: Describe how scenario analysis has been used to inform the identification, assessment and management of climate and nature-related risks.

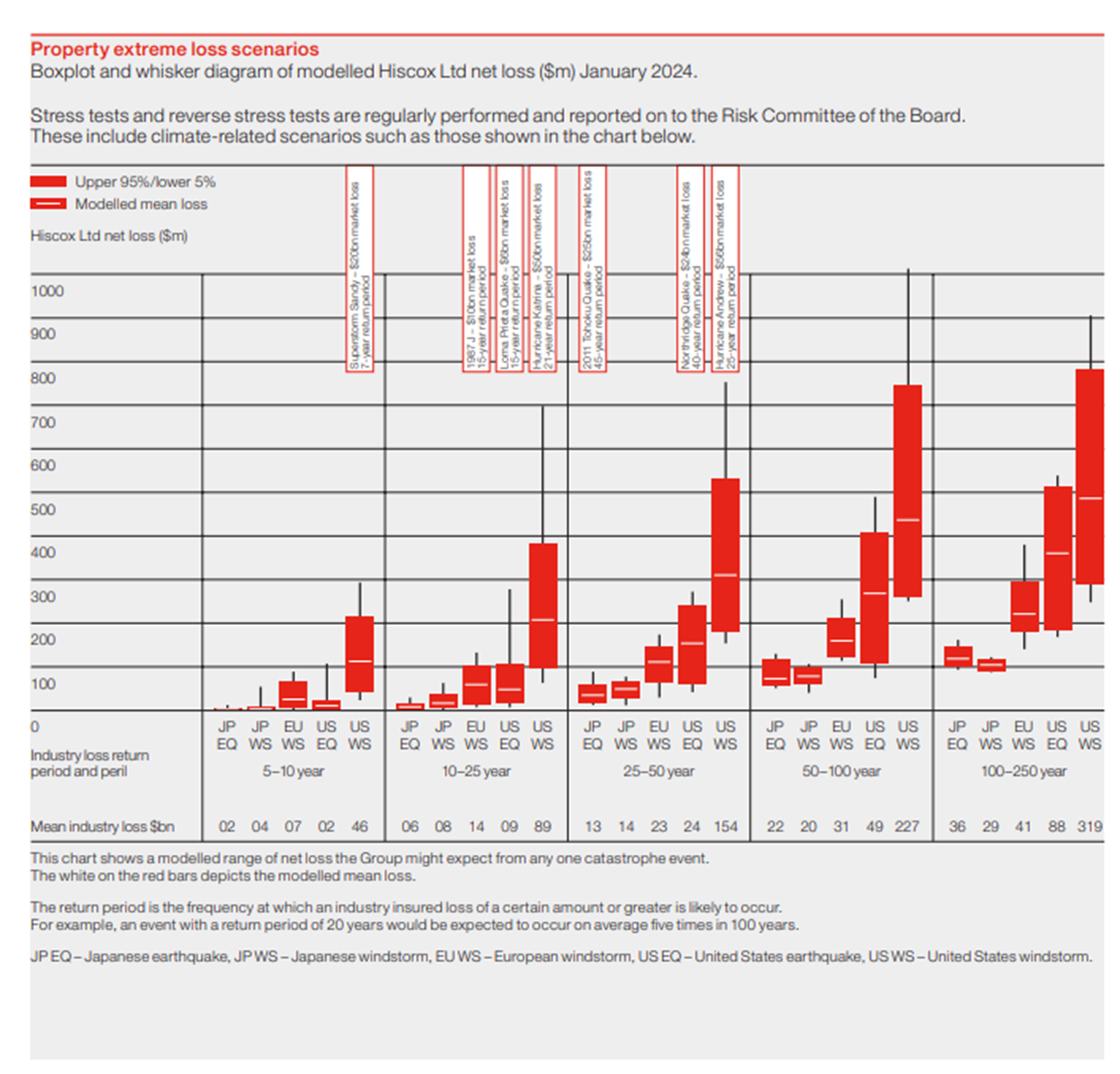

Climate-related stress testing and scenario analysis is achieved both through our own established internal programme of stress testing and scenario analysis and as participants in market-wide activities when they occur, such as the Bank of England’s Climate Biennial Exploratory Scenario (CBES) in 2021 and the PRA’s General Insurance Stress test (GIST) in 2022. Examples of the outputs of our internal work include the property extreme loss scenarios, which show the potential financial impact to the Group of events including Japanese earthquake, Japanese windstorm, European windstorm, US earthquake and US windstorm.

The governance and risk management structures we have in place are critical to the delivery of the annual Group operating plan and ensure a coordinated approach to climate and other issues across the Group. These structures are supported by investments in technology – to ensure the right modelling and data are available to support our pricing and exposure – and by in-house expertise – where we combine off-the-shelf climate views with our own claims expertise and insight to form a unique view (what we call the ‘Hiscox view of risk’). Therefore, we consider the potential impact from climate-related issues over a range of short-, medium- and long-term time horizons. We consider short term to be 0-2 years, medium term to be 2-5 years, and long term to be five years and over, which aligns with some of our business planning timeframes. While in the long term as a property casualty insurer, Hiscox is certainly exposed to climate-related risks, we believe our exposures can be managed through time because of how we conduct our business. For example, through the flexibility we have in our predominantly annual underwriting contracts, and through the liquidity of our investment portfolio which lends itself to constant adjustment. This flexibility is our key tool for managing the multi-decade challenge of climate risks holistically.

We also conduct our own in-house stress testing and scenario analysis and contribute to industry events which can help us manage the risks related to climate impact. While there was not an industry-wide exercise in 2023, in 2022 Hiscox Syndicate 33, Syndicate 3624 and Hiscox Insurance Company (HIC) participated in the Bank of England’s General Insurance Stress Test (GIST). The objectives of the GIST 2022 exercise were to assess resilience to severe but plausible natural catastrophe, as well as cyber scenarios, to gather information about firms’ modelling and risk management capabilities and to enhance the PRA’s and firms’ abilities to respond to future shocks. While the exercise did not aim to assess the financial impact specifically from climate change, the climate-related (atmospheric) scenarios it explored – US hurricanes, European/UK windstorms and UK flood – represented severe but plausible realisations of current climate conditions chosen to reflect firms’ exposures and business models. Industry-wide stress tests such as the GIST support our established and embedded programme of internal stress testing and scenario analysis and contribute to their continued evolution. The individual entity ORSA’s also reflect our approach to managing and monitoring climate-related risks.

Theme: Operations

Sub-Principle 2.1: Manage and seek to reduce the environmental impacts of the internal operations and physical assets under our control.

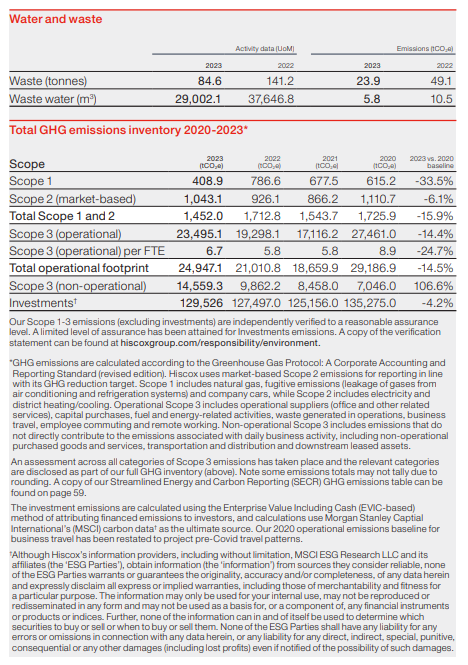

Central to our efforts to manage our environmental impact is our environmental policy and a set of targets for the reduction of GHG emissions developed and announced in 2021. The targets, which were developed using SBTi methodologies and designed to align with a 1.5°C net-zero world by 2050, are:

- reduce our Scope 1 and 2 emissions by 50% by 2030, against a 2020 adjusted baseline;

- reduce our operational Scope 3 emissions by 25% per full-time equivalent (FTE) by 2030, against a 2020-adjusted baseline;

- transition our investment portfolios to net-zero GHG emissions by 2050 – with further interim targets

- we aim for more than 25% of our corporate bond portfolio by invested value to have net-zero/Paris-aligned targets by 2025

- we are targeting an additional 25% by AUM coverage every five years as we aim to be on a linear path to 100% portfolio coverage by 2040.

The actions to meet our scope 1, 2 and operational scope 3 targets are embedded in our sustainability strategy and progressed through the Impact pillar, owned by our Chief Operations and Technology Officer. Examples of these actions include engaging with our landlords to move towards renewable electricity contracts, developing our supplier engagement approach and developing our transition plan. Progress is shared with the SSC on a regular basis via our regular monitoring pack and emissions KPIs.

Our investment portfolio targets are embedded in our investment strategy and actioned is adhered to through the Responsible Investment Policy and the investment manager mandates given to our managers. We are currently making good progress towards the first of our interim targets, with approximately 24% of our corporate bond portfolio having net-zero/Paris-aligned targets as at year end 2023 and we will continue to engage with our managers on further net-zero plans and action.

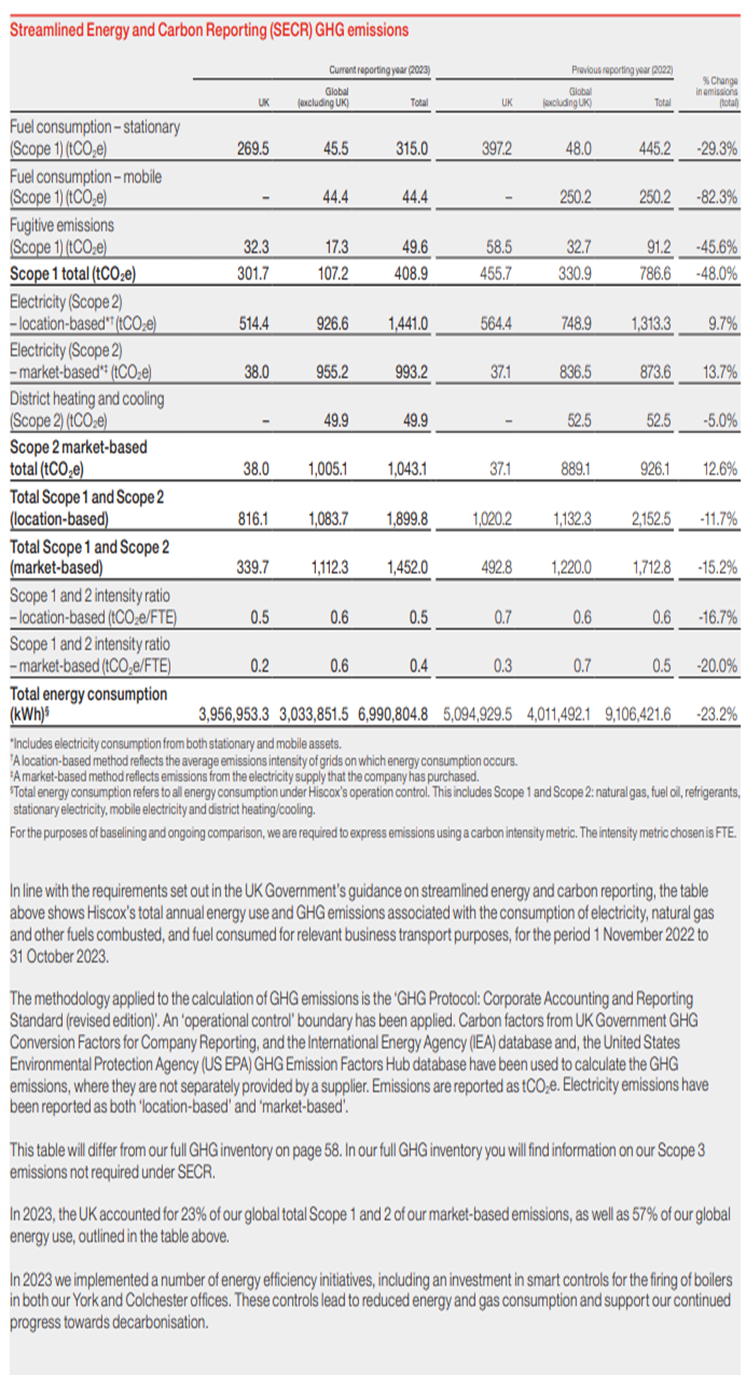

Scope 1 and 2

Our footprint is global and widespread, we continue to focus on managing and reducing our carbon emissions. To do so we have been engaging with our landlords to move towards renewable electricity and other sustainable measures and saw a decrease in our Scope 1 and 2 market-based GHG emissions in 2023 vs 2022. Engagement and influence are key tools in managing the relationships with landlords whom we rely on as majority of our own offices are leased. We capture the data twice a year which enables us to check at half year if our progress is on track and request any additional information that we may require to better understand our emissions. In 2024 we added wording into our leases that supports our requirements to decarbonise our offices, this is termed as ‘Green Leasing’. In addition, we took part in the ESOS exercise, covering our offices in the UK, the intention is to embed the actions from this by the year end. In 2025 we aim to make energy efficiency adaptations to our owned offices where we have more control.

- Hiscox has a 16% reduction in Scope 1 and 2 emissions from its 2020 baseline

- The required reduction to remain in line with the 50% target by 2030 is 15% (5% YOY)

- To continue to meet the scope 1 and 2 target reductions moving forward, a 5% reduction will be required YOY.

Scope 3, operational

Our Scope 3 operational emissions have seen an increase compared to the previous year, driven in part by an increase in operational emissions from purchased goods and services, in line with heightened overall spend in this area in 2023. However, there is also a corresponding increase in upstream transport and distribution (T&D) emissions due to enhanced data capture and reporting. In 2024 we have conducted a re-baselining exercise with improved data and methodologies. In addition, we are aiming to bring our emissions accounting inhouse to improve our ownership and reduce the risk associated with third parties, of which it is currently outsourced. We will share more information in our year end disclosures.

We are in the process of developing our transition plan which will provide more detail on our trajectory to Net Zero. We rely on all of our partners, suppliers, policyholders and investment managers to make progress, so it is vital that we are ensuring we have the relevant lines of engagement in place to work collaboratively. We are also conscious that the transition needs to be just, fair, and take into consideration developing nations. It also needs to consider our impact on nature, biodiversity and affected communities whilst being driven by the latest science. It's not an easy task but we are committed to ensuring progress in this area. Our 2023 carbon emissions data is shown below;

Sub-Principle 2.2: Engage our employees on our commitment to address climate change and nature, helping them to play their role in meeting this commitment in the workplace and encouraging them to make climate and nature-informed choices outside work.

Our employees are key to driving the sustainability progress and ambition of the company and are highly engaged and passionate about the topic. We have multi location Green Teams that support environmental charities such as London Wildlife Trust and Bemuda Zoological Society, campaign for more environmentally friendly processes and generally seek a more sustainable workplace. We conducted a business wide survey asking how employees felt about sustainability and what Hiscox could improve. Around 78% of respondents confirmed that they are either passionate, very passionate or extremely passionate about sustainability and suggested that the areas Hiscox could improve is within our supply chain, offices and underwriting. We also asked if respondents would like to join the Green Team in their relevant location, over 50 people responded positively, and this had led to the development of an EU Green Team. Since then, we have run multiple lunch and learns around climate and nature related issues and how individuals can reduce their own impact.

In 2024 our people team have reviewed our sustainable reward offerings with a view to develop opportunities and are looking to develop a recognition platform for the Group with which we aim to include a sustainability element. We continue to discover and develop new ways to ensure our employees can be more sustainable in their work and personal life.

Theme: Value Chain

Sub-Principle 2.3: Understand and disclose the sources of emissions and adverse climate and nature-related impacts on our upstream and downstream value chain that might in turn impact our business.

We measure and monitor the emissions profile of our supply chain and other areas of upstream and downstream value chain emissions to ensure a clear transparent view of our complete footprint as shown in section 2.1. We are developing our processes to measure the climate and nature related risk of our supply chain. More information will be shared once this work progresses. We actively measure and monitor the sustainability of our investment portfolio and are working towards several targets, of which more detail can be found in section 1.9. We understand the importance of measuring our underwriting portfolio emissions and continue to monitor the development of external methodologies with an aim to embed in the future. Our focus is on risk mitigation and adaptation, more information can be found in section 3.4

Sub-Principle 2.4: Advocate and engage across the supply chain to encourage our suppliers to improve the environmental sustainability of their products and services, and understand the implications these have on our business.

We have a Group procurement team which helps our business to ensure we hire the best companies for the required task. Our supply chain highest spend is predominantly IT services, consultancy fees and legal costs. Our procurement process considers a range of factors as you would expect, and over time we are enhancing our requirements of suppliers and in particular their responsible business practices when it comes to climate and ESG-related issues. We also have a supplier code of conduct, which is publicly available on our website and covers a range of issues – from anti-bribery to human rights and labour practices – including our environmental expectations. As a business, we endeavour to use renewable and cleaner energy sources wherever possible to make a positive impact on the environment, and we want to work with suppliers that share our passion for responsible business, so we encourage suppliers to consider any efficiencies or improvements to their own operations and services that will have a positive impact on the environment. Our supplier code of conduct is shared with suppliers during the tender process and suppliers are reminded of it periodically. Companies bidding for large contracts from us must prove they meet ISO standards, including for quality, environment and information security, as well as answer questions on their ethical, social, health and safety and data protection practices.

Financial Services Qualification Scheme (FSQS) operated by Hellios, is a market leading supplier due diligence community which is used by many other Financial Services organisations. FSQS provides a standard and simple mechanism for collecting and managing supplier assurance information across the Group and across the wider Financial Services community. FSQS is an integral part of our sourcing process. Our Sourcing Specialists use the system to find pre-qualified suppliers to be considered for new business. Qualified supplier status gives visibility across our Procurement process and, therefore, creates potential new opportunities. FSQS is a two-stage process, with Stage 1 assessing the risk of the supplier including access to customers, location of services, access to data, etc. All risk responses are reviewed, including forced labour and modern slavery. If the supplier is deemed to be low risk, the process stops after Stage 1. For all other suppliers that must move on to Stage 2, they must answer a variety of questions linked to risk, including questions relating to environmental practices, human rights and modern slavery.

EcoVadis, is a global ESG platform. At the point of tender, all suppliers are notified that they may be selected and required to complete the EcoVadis assessment. Hiscox reviews the reports of these suppliers which can identify any gaps or incidents of note. No incidents have been found, but if one is identified the relevant risk functions would be notified and the issues would be addressed with a prompt and thorough review. Both of these partnerships enhance our supplier due diligence assessments.

We ask suppliers to consider the following actions;

- measure and report their Scope 1 and 2 carbon emissions annually;

- set GHG reduction targets for Scope 1 and 2, preferably in line with a 1.5°C trajectory and report progress regularly;

- develop and share a carbon management plan, including a plan to measure and reduce Scope 3 (value chain) emissions over a defined time frame – preferably to 2030;

- sign up to relevant industry/business commitments focused on climate change and nature, preferably those that demonstrate a commitment to net-zero emissions by 2050 at the latest.

In 2023-4 we have been targeting engagement to increase the EcoVadis coverage of our supply chain. For suppliers who have reported via EcoVadis we have been working through the action plans produced by EcoVadis to improve the supplier’s sustainability credentials. The action plans often consist of a requirement for policies to monitor and manage climate and nature impacts and social impacts, publication of actions to meet Net Zero or certifications such as ISO accreditations. We request this action of our suppliers, then monitor and engage with them regularly. We aim to set engagement targets and embed EcoVadis further in 2024/5.

How we currently work with suppliers

We also make a few commitments in our Group environmental policy about the resources and products we buy. These include:

- minimising our climate change impacts by purchasing, where we can, energy from renewable sources;

- seeking to replace air conditioning gases with environmentally friendlier alternatives;

- operating energy-efficient office equipment and communications systems;

- using our leverage to further best practices in sustainability and social responsibility, for example by investing in companies with sound ESG practices.

This practice is also prevalent in our vendor management processes on the claims side, we have an ESG assessment that vendors must complete and through regular engagements they are required to improve their ESG practices.

Theme: Innovate & Advocate

Sub-Principle 2.5: Support and undertake research and development to inform current business strategies, develop new products, and help support and incentivise our customers and stakeholders, including affected communities, in adapting to and mitigating climate and nature-related issues.

As part of the climate risk mitigation focus of our risk adaptation pilar within our sustainability strategy, Hiscox has been helping to plug the insurance protection gap for countries and communities around the world by founding and chairing the Lloyd’s Disaster Risk Facility. Alongside five other Lloyd’s syndicates who work together as part of the facility, we aim to design and support initiatives in areas of the world where insurance is unaffordable, or simply does not exist at all. The facility focuses on providing crisis and climate-related disaster risk financing solutions to reduce vulnerability, and support the risk transfer mechanisms across all stages of the disaster cycle from emergency response through to reconstruction. Following a disaster caused by natural or anthropogenic hazards, pre-arranged finance (such as insurance) can significantly reduce the cost, impact and recovery time, by ensuring financial support reaches those who need it most. The Lloyd’s Disaster Risk Facility operates globally with streams of distribution including the Lloyd’s chaired Sustainable Markets Initiative, and the Insurance Development Forum (IDF), which is a public-private partnership, and led by the insurance industry. Examples of support include:

- participation on the IDF’s Sovereign and Humanitarian Solutions working group, which together with the United Nations Development Programme (UNDP) and InsuResilience Solutions Fund (ISF), aims to address the insurance needs of the most climate vulnerable sovereigns, and humanitarian organisations operating in these nations.

- provision of reinsurance for the major risk pools across the globe, providing capacity to: the South East Asian Risk Disaster Insurance Facility (SEADRIF) for flood risk in Laos; the African Risk Capacity (ARC) for drought, flood and cyclone risks across more than 20 nations in Africa; the Caribbean Catastrophe Risk Facility (CCRIF SPC) for excess rainfall, hurricane and earthquake risk in the Caribbean and Latin America; and the Pacific Catastrophe Risk Insurance Company (PCRIC), which supports small island nations, and responds to the risk of earthquake, tsunami and cyclone in the south Pacific region. The Lloyd’s Disaster Risk Facility has a global scope and is peril agnostic, engaging with clients located all over the world.

- providing support to the United Nations Children’s Fund (UNICEF) Today and Tomorrow initiative, which focuses on providing rapid pay-outs following cyclone events in eight countries across four global cyclone basins - Bangladesh, Comoros, Haiti, Fiji, Madagascar, Mozambique, Solomon Islands, and Vanuatu. These insurance pay-outs are then used in the immediate aftermath of such an event, responding to the needs of vulnerable children and helping to mitigate the impacts.

- Partnered with Aon and the International Federation of Red Cross and Red Crescent Societies (IFRC), implementing reinsurance solution which protects IFRC’s Disaster Response Emergency Fund (DREF), allowing the local societies of the Red Cross and Red Crescent to respond to more natural hazard related disasters in a timely manner.

We are continuously developing products that are necessary for our customers in the short, medium and long term and that consider changing needs including in relation to a changing climate. What that looks like varies by business area; for example, through our participation in Flood Re in the UK, we are better positioned to provide flood insurance to some clients that are in high-risk flood areas, and in the USA our FloodPlus products similarly improve market access to affordable flood cover.

Sub-Principle 2.6: Promote and actively engage in public debate on climate- and nature-related issues and the need for action by publicly communicating our beliefs and strategy on climate and nature related issues and providing support and tools to our customers/clients so that they can assess their levels of risk.

We communicate our beliefs and strategy on climate and nature related issues via various channels:

Through the media

We contribute to the climate debate by publishing relevant insight and research – either our own or by working with others – and also through sharing news and views. During 2023-24, this has included the following articles:

Environmental

- Small business owners on how to make their business more sustainable

- Why businesses should become environmentally friendly

- The role of Black women in business

- Maximising opportunities: Grants for Black women entrepreneurs

- Show your LGBTQ+ pride as a business or an ally

- How to get certified as a women owned small business

Social

Governance

- Global tech outage highlights critical lessons for small business owners

- Essential strategies and tips for yearend success.

In addition our annual impact report, which alongside the social impact that Hiscox makes through our colleagues, customers and communities, details some of the climate-focused initiatives we are involved in, such as London Wildlife Trust and The Country Trust’s Plant Your Pants campaign, Ocean Generation and the Bemuda Zoological Society.

Through investor communications

ESG and climate-related issues are increasingly part of our direct dialogue with analysts and investors. To support those conversations, we have produced an investor-focused ESG presentation, which is publicly available on our Hiscox Group website. This presentation complements other ESG and climate-related communications to analysts and investors which take place as part of our preliminary and interim results presentations each year.

Through our customer engagement

We regularly engage with our customers in order to capture crucial customer insight, and in 2022-23, we introduced new ways to reflect sustainability in our customer research including brand tracking. We also understand customer insights through our research and insight teams and networks and partners.

Through our websites

Our corporate website – which is viewed by our customers, broker partners, suppliers, other businesses, analysts, investors and journalists – has a section dedicated to the environment (including climate and nature issues) and is one of our richest sources for explaining how we go about being a responsible business.

- our annual climate report

- the Sustainability and TCFD sections of our Annual Report and Accounts

- information on our carbon emissions and carbon management plan, including our carbon offset programme;

- links to our ESG-related reports, policies and disclosures;

- links to recent climate-related papers and articles we have published;

- our membership of ClimateWise;

- an explanation of how we help customers adapt to climate change;

- our market resilience white paper, the result of an initiative spearheaded by our Chairman involving 23 other organisations in London to test their preparedness for a major hurricane simultaneously with a large-scale cyber attack;

- information on our ‘green teams’.

Through our engagement with external bodies

- CDP;

- ClimateWise;

- Dow Jones Sustainability Index;

- Institutional Shareholder Services (ISS);

- MSCI;

- Sustainalytics.

- PRI

- PSI

Sub-Principle 2.7: Where appropriate, work with policy makers and share our research with scientists, society, business, governments and NGOs in order to advance a common interest.

Currently our investment portfolio is where we are most active in encouraging our investment managers to engage in public debate but also engage with policy makers. We use our investment mandates to align the portfolios to our strategic requirements and therefore ESG commitments.

An example from one of our external managers:

"Most recently, we have engaged through letters, public consultation responses, and government backed working groups on:

- The European Commission public consultation on the Level 1 review of SFDR to support the enhancement of the current regime through streamlined disclosures and, potentially, the introduction of voluntary labels

- The ESAs consultation regarding amendments to the SFDR’s RTS to provide constructive feedback on the impact of certain changes, including the introduction of new templates and transparency requirements

- The European Commission’s draft ESRS to highlight the important of aligning asset managers’ disclosure requirements to what companies are required to report on under the ESRS and the Corporate Sustainability Reporting Directive

- The ISSB. By serving as a member of the ISSB Investor Advisory Group, we share our practitioner’s views on the global baseline and what we believe should be the next priorities

- The TNFD Disclosure Framework to highlight the challenges and opportunities of nature-related reporting for financial institutions. As part of the TNFD Forum, we are actively contributing to the work of the Taskforce through consultations

- The U.S. SEC proposed rule on ESG disclosures by funds and investment advisers, which we believe will help investors make better informed investment decisions and understand how ESG factors are or are not used in the management of their assets

- The U.K. FCA consultation paper on its SDR, introducing a disclosures, naming, labelling and marketing regime

- The Australian Treasury’s Consultation Paper regarding greater transparency of proxy advice We also find it valuable to be an active member in key industry groups to debate and share our practitioner views on emerging policy issues, including the PRI’s GPRG, the IIGCC’s Bondholder Stewardship Group, the ACGA, the Investment Association’s Climate Change Working Group, and the Board of the US SI

Other key areas of engagement are;

Lloyd’s - Sustainable Markets Intiative

As a long-standing Lloyd’s of London participant, we contribute to a number of Lloyd’s focused initiatives. Previously this has included the insurance task force, which is designed to provide a platform for the sector to collectively advance the world’s progress towards a resilient, net-zero economy, and is being led by Lloyd’s at the invitation of the former Prince of Wales.

ClimateWise